Scenario generation

The sensitivity of a project with resepct to adverse conditions is an important indicator for the risk tolerance and thus the quality of an investment. Our approach provides a large universe of standard scenarios sets of the construction and operation phase. In addition our approach allows defining customized stress scenarios. Typical scenarios include increase of costs, delays during the construction phase, a fall of revenues or increase of expenses during the operation phase. Beside the project specific factors we consider market and credit risk factors like interest rate and inflation rate changes, credit spread widening and the impact of changes to feed-in tariffs, tax rates or other regulatory or fiscal conditions. As a result we derive a risk matrix which shows the impact of each scenario on the set of financial and performance key figures of the project. Sample risk matrices for various project types are shown in the resources section.

The sensitivity of a project with resepct to adverse conditions is an important indicator for the risk tolerance and thus the quality of an investment. Our approach provides a large universe of standard scenarios sets of the construction and operation phase. In addition our approach allows defining customized stress scenarios. Typical scenarios include increase of costs, delays during the construction phase, a fall of revenues or increase of expenses during the operation phase. Beside the project specific factors we consider market and credit risk factors like interest rate and inflation rate changes, credit spread widening and the impact of changes to feed-in tariffs, tax rates or other regulatory or fiscal conditions. As a result we derive a risk matrix which shows the impact of each scenario on the set of financial and performance key figures of the project. Sample risk matrices for various project types are shown in the resources section.

Risk aggregation

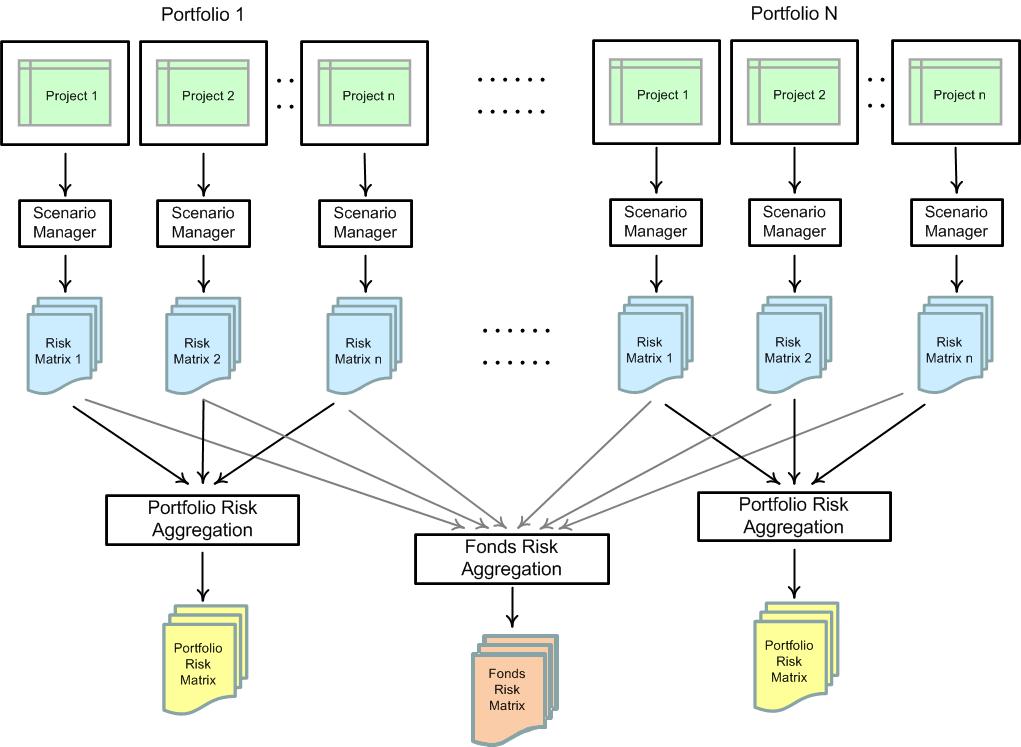

The aggregation of risk matrices on the portfolio and funds level is performed under consideration of the risk specific dependency structure. Common risk factors like the increase of interest rates or percentage cost increase are aggregated horizontally, the impact of project specific factors like project type, technology or regional factors are aggregated using a pre- or user- defined correlation structure. The following diagram illustrates the risk aggregation on different hierarchy levels.

The aggregation of risk matrices on the portfolio and funds level is performed under consideration of the risk specific dependency structure. Common risk factors like the increase of interest rates or percentage cost increase are aggregated horizontally, the impact of project specific factors like project type, technology or regional factors are aggregated using a pre- or user- defined correlation structure. The following diagram illustrates the risk aggregation on different hierarchy levels.